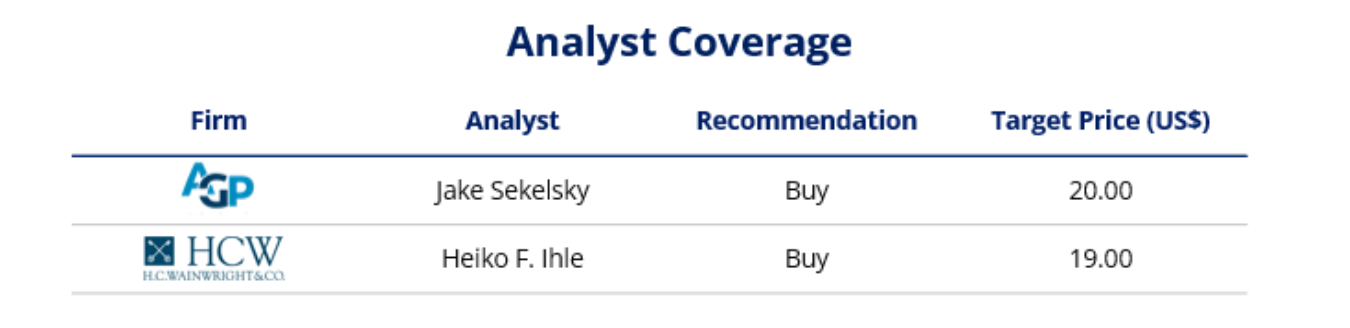

Pre-market is Lighting Up! (NASDAQ:ATLX) The U.s Govt just announced yesterday that it is seeking a posistion in a U.S lithium Mine!! Supply and demand baby! Lithium is already in short supply and with the U.S govt stepping on the dance floor could this push lithium prices back where they once were?? The pieces are starting to come together humans.. and ATLX May stand to reap all the benefits!! LITHIUM ALERT: One Tiny NASDAQ Firm Could Be Sitting on a BILLION-DOLLAR Lithium Jackpot!Forget the noise—the lithium comeback is REAL, and one under-the-radar NASDAQ firm may become the biggest breakout story of them all.Atlas Lithium (NASDAQ: ATLX) isn't just another explorer. It's the LARGEST holder of lithium exploration acreage in Brazil—ground zero for the next global lithium boom—and the market is just beginning to wake up.- Wall Street Price Targets Soaring: HC Wainwright Says $19

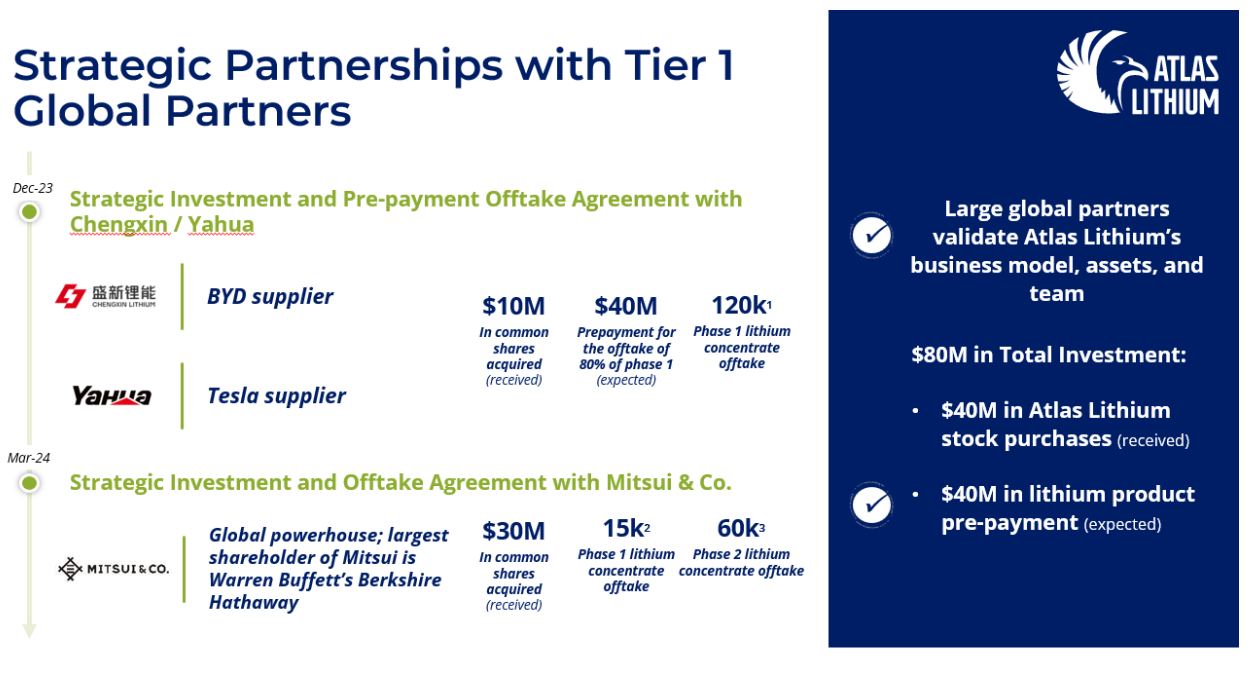

- Mitsui Invested $30 MILLION at a Premium (Backed by Berkshire Hathaway!)

- Massive Projects Near Billion Dollar Lithium Giant Sigma (NASDAQ: SGML)

- Market Cap Around $100M – Potential for GROWTH

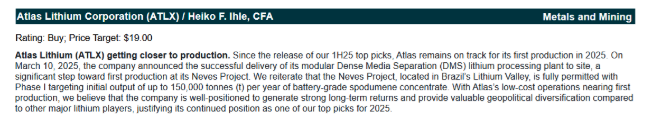

Atlas Lithium's Neves Project Delivers Industry-Leading 145% IRR and Rapid 11-Month Payback in Definitive Feasibility Study, Cementing Its Position as One of the Lowest-Cost Lithium Producers Globally with Strong Funding Backing and Significant Growth Potential!The company has also secured two non-dilutive pre-payment agreements for its lithium concentrate totaling $40 million and has received additional funding interest from other parties, including 10-year debt financing options, any of which could support the Project's capital requirements.The fact that multiple parties are showing interest in - funding the project — signals strong investor and lender confidence in the project's viability and the company's management.OverviewFocused on moving from exploration to profitability; Atlas Lithium Corporation (NASDAQ: ATLX) is a U.S.-based mineral exploration company with the largest size and breadth of exploration projects for strategic minerals in Brazil, a premier mineral jurisdiction. ATLX intends to be a leader in the provisioning of minerals essential to the transformation of the global economy from fossil fuels to electrification, a process which is expected to take decades.  Discover how ATLX is positioned to become the "Mineral Resources Company for the Green Energy Revolution!" With esteemed institutional shareholders and significant price targets from esteemed analysts, ATLX may be one of the most undervalued companies hiding in the Lithium boom.SMART MONEY SEES IT: HC WAINWRIGHT TARGETS $19!ATLX landed on the "Top Picks" list from HC Wainwright, which issued a $19 target—that's nearly 4X upside from current levels. And that was BEFORE the processing plant landed and before exploration confirmed multiple high-grade anomalies.

ATLX was featured in the "Top Picks" list from HC Wainwright with a target price of $19! See what the firm had to say below:

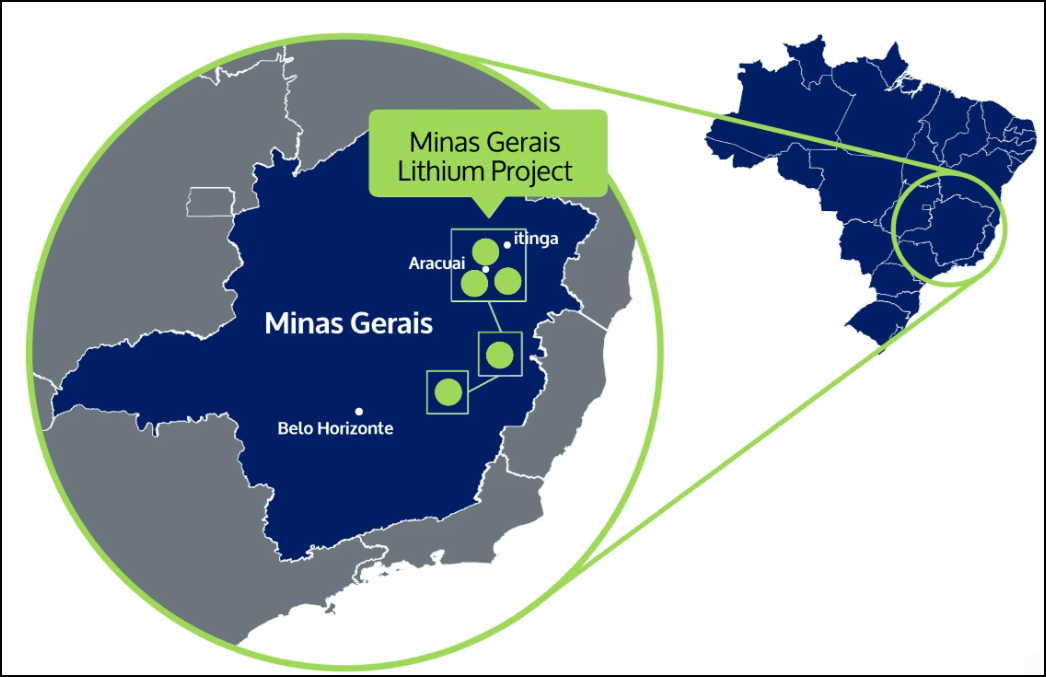

BIG POTENTIAL HIDDEN IN PLAIN SIGHTAtlas Lithium isn't playing small ball! The company controls over 539 km² of strategic mineral rights in lithium. But it's Lithium Valley in Minas Gerais, Brazil, that could make ATLX a household name. WHY BRAZIL?- Open-pit mining + low labor costs = ultra-low cost of production

- Government fast-tracking mining permits

- Year-round mining with clean energy access

- Brazil just landed $370M in lithium M&A from Pilbara Mineral, a major Australian lithium producer

- Up to $5.8 billion projected lithium investment by 2030

Over the last several years, Atlas Lithium has assembled Brazil's largest portfolio of lithium mineral rights among publicly listed companies. ATLX holds three key projects that span the major lithium-mineralized zones in LV: - The Neves Project in southern LV, Atlas Lithium's flagship development, which has recently been permitted and is advancing towards production;

- The Salinas Project in northern LV, spanning 2,070 acres with natural spodumene outcrops, and is located 4.7 miles from Latin Resources Ltd., and with potential for spodumene deposits;

- The Clear Project in central LV, which encompasses 470 acres, is situated 3.8 miles from Sigma Lithium's (NASDAQ: SGML) Grota do Cirilo mine. There is also potential for spodumene deposits. Sigma Lithium has a market cap of almost a BILLION Canadian Dollars!

BREAKING NEWS: Atlas Lithium's Neves Project Unveils Game-Changing Feasibility Study—145% IRR & 11-Month Payback Signal Massive Investment Opportunity!

The company believes that the DFS validates the Project's strong economics, positioning it among the most capital-efficient and lowest-cost hard-rock lithium developments globally.Atlas Lithium Corporation (NASDAQ: ATLX) just delivered a landmark milestone that investors cannot afford to overlook. The company announced that SGS Canada Inc. has completed a Definitive Feasibility Study (DFS) for its 100%-owned Neves Lithium Project in Brazil, revealing an eye-popping internal rate of return (IRR) of 145% and an ultra-fast payback period of just 11 months. This low-cost, open-pit spodumene project, situated in Brazil's lithium-rich Minas Gerais state, boasts an after-tax net present value (NPV) of $539 million and operational production costs estimated at only $489 per tonne of lithium concentrate—placing Atlas Lithium firmly among the world's lowest-cost lithium producers. Key takeaways investors must note: - Capital Efficiency: Total direct capital expenditures are expected to be a mere $57.6 million, the lowest of any lithium project announced in Brazil. Atlas Lithium has already invested $30 million in a dense media separation (DMS) plant, ready to be deployed.

- Robust Funding Options: The company has secured $40 million in non-dilutive pre-payment agreements for lithium concentrate and is exploring 10-year debt financing for the remaining minor part of CapEx, reducing reliance on equity and enhancing shareholder value.

- Low-Risk, Proven Tech: The project will utilize proven DMS technology with a strong lithium recovery rate of 61.7%, ensuring a straightforward processing operation with minimal environmental impact and operational risk.

- Regulatory Advantage: Atlas Lithium holds the highest mining concession status ("Portaria de Lavra") in Brazil, allowing continuous mining operations and strong legal footing.

- Growth Potential: Multiple deposits remain open for expansion, with untapped geological targets providing ample opportunities to extend mine life and boost production.

CEO Marc Fogassa emphasized the significance: "The DFS indicates potentially outstanding returns for our initial vision of developing a focused, near-term, profitable lithium production asset with minimal capital requirements. The combination of low capital intensity and rapid payback is expected to create exceptional value for our shareholders." With the DFS confirming exceptional economics and with multiple potential funding pathways, Atlas Lithium is positioned to accelerate toward production and capture significant upside. Investors should closely watch ATLX for potential momentum as development advances!In the Right Place at the Right TimeWithin the global lithium industry, Brazil's LV has emerged as a premier hard-rock lithium jurisdiction. Brazil's advantages include year-round mining operations, lower labor costs, and a supportive government. The country's lithium industry outperforms Australian producers on costs; Pilbara Mineral's US$370M acquisition of a Brazilian lithium explorer in August 2024 highlights the region's importance.

"Investments in lithium production in Minas Gerais are projected to range from $3.9 billion to $5.8 billion by 2030," according to João Paulo Braga, CEO of the state investment promotion agency, Invest Minas.  Few countries besides Brazil have such an advantageous position to attract investment, as other Latin American nations face uncertainties and political risks. ATLX's has the largest lithium exploration portfolio in Brazil with 98 mineral rights spanning approximately 539 km2. Several of the company's mineral rights are located adjacent to or near mineral rights that belong to a large publicly traded competitor company which has demonstrated through extensive drilling the presence of lithium deposits totaling over 100 million tons, according to its publicly available filings! This is a Highly Attractive Location: ◼ Resource Potential to Support Large Scale Operations

✓ The Brazilian Geological Service (CPRM) suggested that the region has at least 45 lithium deposits

✓ Adjacent to operational lithium mines in the region such as Sigma Lithium and CBL ◼ Licensing Fast Track to Speed up Project Execution – Atlas with Permits in Place

✓ Minas Gerais government created a fast-track process, under the InvestMinas Program, to facilitate project development and allow for licensing to be issued quickly

✓ Mining friendly jurisdiction: 300+ operating mines in the state of Minas Gerais ◼ Favorable Infrastructure

✓ Access to abundant renewable & clean energy sources and highway roads directly connected to intercontinental ports to supply main markets Recent exploration activities at both the company's Salinas and the Clear Projects have yielded significant progress, and such development bodes well for ATLX's strategy of securing as many high-quality deposit areas within LV as feasible. A NEIGHBORING A LITHIUM POWERHOUSEAtlas Lithium's acreage borders Sigma Lithium (SGML), with nearly a BILLION dollar valuation. ATLX's Clear Project is just 3.8 miles from Sigma's Grota do Cirilo mine. INSTITUTIONAL VOTE OF CONFIDENCE: $30 MILLION FROM MITSUIIn 2024, Japanese mega-conglomerate Mitsui (yes, the one whose biggest shareholder is Warren Buffett's Berkshire Hathaway) plowed $30M into Atlas Lithium at a 10% premium. The deal came with a massive lithium offtake agreement—highlighting that ATLX is not just a hopeful explorer. It's on the fast track to revenue. In a transformative development, Atlas Lithium secured a strategic partnership with Mitsui & Co., Ltd., one of Japan's largest global trading and investment companies with operations in over 60 countries. In March 2024, Mitsui demonstrated its confidence in Atlas Lithium's potential by making a substantial US$30 million strategic investment at a 10% premium to market price. The partnership includes a significant offtake agreement lithium concentrate from Atlas Lithium's Neves Project. Notably, Mitsui's largest shareholder is Warren Buffett's Berkshire Hathaway, adding another layer of institutional validation to Atlas Lithium's business model. PLANT ARRIVES = NEAR-TERM PRODUCTIONAtlas isn't waiting around. Its state-of-the-art Dense Media Separation (DMS) lithium processing plant just landed in Brazil. Permitted and fully paid-for, this facility brings Atlas firmly into pre-production stage. It will be Brazil's first modular DMS plant, and it's engineered for eco-friendly, water-efficient lithium extraction. CEO Marc Fogassa said it best: "We have overcome two of the most significant hurdles on our journey to production." CEO SKIN IN THE GAME: MIT + HARVARD EDUCATED + 26% OWNERSHIPAtlas's CEO isn't a suit. He's a biotech MD and MIT-trained engineer turned investor—who just happens to own 26% of the company himself. That's shareholder alignment you RARELY see in this sector. Brazilian born CEO Marc Fogassa has a 25-year career in executive management, private equity/venture capital. He has extensive direct investing experience, including cross-border deal structuring, due diligence, management build-up, and Board of Directors oversight. Fogassa double majored at the Massachusetts Institute of Technology (MIT), earning Bachelor of Science degrees in Electrical Engineering and Biology. He subsequently graduated from the Harvard Medical School with a Doctor of Medicine degree and later from the Harvard Business School with a master's in business administration degree. Marc Fogassa is the largest shareholder of Atlas Lithium himself, with ~26% of outstanding common shares. This is a vote of confidence from the man in charge and it showcases full CEO's alignment with shareholder interests. THE THREE CROWN JEWELS: ATLAS'S CORE PROJECTS- Neves Project: Permits in hand. Production is imminent. Of significant strategic value.

- Salinas Project: Pegmatite-rich with assays ranging from 2.31% to 4.97% Li₂O.

- Clear Project: Right next to Sigma Lithium. Soil + geophysical studies point to buried spodumene swarms.

All three are in the heart of Lithium Valley, surrounded by proven multibillion-dollar resources. Recent exploration confirms spodumene at multiple locations. Lithium Projects: Highlights - The Salinas Project continues to demonstrate its substantial potential, with recent detailed geological mapping revealing two outcrops of spodumene-rich pegmatites in the northwest portion of the mineral property, coinciding with a northeast-southwest trending lithium soil anomaly. Additionally, lithium mineralization has been determined in at least three pegmatites, with geochemical assay results ranging from 2.31% to 4.97% Li2O. Laboratory analysis of detailed soil sampling within the claim has identified at least three parallel north-south and northeast-southwest lithium anomalies associated with mapped pegmatites. The Company has undertaken geophysical surveys and such results have been consistent with the probability of one or more lithium deposits within the claim.

- At the Clear Project, detailed geological mapping of the claim has resulted in the discovery of two pegmatites, with completed soil sampling revealing a substantial northeast-southwest trending lithium anomaly associated with a mapped pegmatite, suggesting the presence of a buried pegmatite swarm. The Company's technical team has completed an initial round of geophysical studies which have been favorable for the potential of one or more lithium deposits within the mineral right.

- The Company's strategic approach prioritizes the Neves Project for initial production, while simultaneously advancing exploration at the Clear and Salinas Projects. Over the last several quarters, Atlas Lithium has enhanced its geological assessment methodology through a comprehensive multi-step process: detailed geological mapping, zoned and detailed soil geochemical analysis, and advanced geophysical surveys including LIDAR and magnetic surveys. In the Company's experience, such systematic approach has demonstrated accuracy in identifying potential spodumene deposits. Given the favorable results so far, the Company is expected to expand its exploration budget in 2025 to accommodate for drilling in both the Clear Project and the Salinas Projects.

The Neves Project Has Already Received All Permits Needed to Assemble its Processing Plant and Operate! "We are thrilled with today's announcement, as permitting is widely considered the most critical risk in any mining project. Atlas Lithium's permit reflects fourteen months of our team's meticulous work throughout the licensing process (…). This milestone marks a key step for us towards becoming a lithium producer and advances Atlas Lithium into the next phase of our growth trajectory."

"We are committed to being a responsible corporate citizen for all our stakeholders. With the news provided today, and as the Neves Project proceeds towards implantation and operation, Atlas Lithium will create hundreds of local jobs in the Vale do Jequitinhonha area of Minas Gerais. Additionally, our lithium processing plant is engineered to possibly achieve the smallest environmental footprint in its class." – Director Rodrigo Menck

Strengthening Project Implementation Expertise with Eduardo QueirozEduardo Queiroz joins Atlas Lithium as Project Management Officer (PMO) and Vice President of Engineering, bringing over 20 years of hands-on experience managing complex, large-scale mining projects, and making him the perfect addition to drive the Company's Neves Project to revenue generation. Mr. Queiroz has more than two decades of expertise in managing large-scale and complex mining projects, most recently as General Manager of Planning and Management at Bamin, a unit of Eurasian Resources Group, where he successfully led the strategic planning of several projects over US$3 billion, including an integrated iron ore mining project encompassing mining operations, processing plant, railway, and ocean port facilities. His comprehensive experience includes engineering oversight, environmental compliance, risk management, and the implementation of cost-efficient operational strategies. He holds an MBA in Project Management from Fundação Getúlio Vargas and a degree in Civil Engineering from the Universidade Federal de Ouro Preto.

"Eduardo's arrival could not come at a better time," said Marc Fogassa, CEO and Chairman of Atlas Lithium. "As we prepare to transition into production, his proven track record in the implementation of Brazilian mining projects will be instrumental in our success. We are honored and thrilled to have him on our team." Lithium might just be the hottest commodity to watch as we get closer to 2030 and could yield long-term opportunities for ATLX! Why Lithium?Lithium is on the list of the 35 minerals considered critical to the economic and national security of the United States as first published by the U.S. Department of the Interior on May 18, 2018.

In June 2021, the U.S. Department of Energy published a report titled "National Blueprint for Lithium Batteries 2021-2030" (henceforth, the "NBLB Report") which was developed by the Federal Consortium for Advanced Batteries ("FCAB"), a collaboration by the U.S. Departments of Energy, Defense, Commerce, and State. According to the Report, one of the main goals of this U.S. government effort is to "secure U.S. access to raw materials for lithium batteries."

In the NBLB Report, Ms. Jennifer M. Granholm, the U.S. Secretary of Energy, states: "Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid storage, critical to developing the clean-energy economy."

The NBLB Report summarizes as follows the U.S. government's views on the needs for lithium and the expected growth of the lithium battery market:

"A robust, secure, domestic industrial base for lithium-based batteries requires access to a reliable supply of raw, refined, and processed material inputs…"

"The worldwide lithium battery market is expected to grow by a factor of 5 to 10 in the next decade." Is Lithium Poised for a Major Comeback? An anticipated surge in demand, coupled with expanding supply capacities, indicates a potentially lucrative rebound for the lithium market which could present significant investment opportunities. A lithium rebound could bode well for many lithium companies including Atlas Lithium Corporation (NASDAQ: ATLX). The rebound in lithium stocks got underway in 2024 when the world's largest miner of the metal, Albemarle revealed plans to cut production and spending. Smaller peer Arcadium Lithium quickly followed. The moves stirred hopes that lithium supplies would soon revert closer to current demand.

Investor enthusiasm continued in October of 2024 when the mining world's second-largest enterprise, Rio Tinto, sealed a $6.7 billion deal to take over Arcadium. The acquisition will make Rio a top lithium supplier. Why did Rio Tinto make such a big move? The mining giant is moving to solidify its position when lithium prices are near cyclical lows. Are there any compelling reasons for investors to consider buying lithium stocks now? Plenty.- Significant demand drivers are in place for lithium. Lithium is pivotal in the production of rechargeable batteries for mobile phones, laptops, digital cameras, and electric vehicles.

- The International Energy Agency (IEA) projects that clean energy technologies will increase global demand for lithium by nearly 90% over the next two decades.

- Strategic initiatives are underway to tighten lithium supply through mine closures and the deferral of new projects. These moves aim to address the excess supply that has contributed to the prolonged downturn in the lithium market.

- Many oil and gas giants are foraying into lithium production as efforts to curb emissions gain momentum, amid the global transition from fossil fuels to cleaner energy. This includes Buffett's Berkshire Hathaway Energy Renewables and Occidental Petroleum and ExxonMobil.

- Recent M&A in the Lithium mining space should encourage further consolidation. In October of 2024, Rio Tinto agreed to buy Arcadium Lithium plc (ALTM) for $5.85 per share in cash, bringing the total value of the deal to $6.7 billion. In December of 2024, Australia's Sayona Mining and U.S.-based Piedmont Lithium (PLL) agreed to merge in an all-stock transaction to form a unified lithium business. Pilbara Minerals Ltd. demonstrated further industry consolidation through its strategic acquisition of Latin Resources Ltd. for approximately $370 million, notably targeting assets in Brazil's Lithium Valley near Atlas Lithium's operations, which validated the region's growing importance in the global lithium supply chain.

What's Driving the Battery Metals Revolution?The Battery Metals Market has seen substantial growth, driven primarily by the increasing demand for electric vehicles (EVs) and renewable energy storage solutions.

These battery metals are being utilized more frequently in batteries for consumer electronics, electric vehicles, and other uses. Brine and hard rock deposits found in countries with economies like China, the Americas, Australia, Canada, Brazil, and Portugal are sources of lithium metal. In lithium-ion batteries, cobalt is most frequently utilized as the cathode material. Nickel has a high energy density and storage capacity, making it a good choice for battery applications. Increased use of smartphones, tablets, and other electronic gadgets has positively impacted the global battery metal market.

According to recent market reports, the global battery metals market is currently valued at around $11.35 billion and is projected to reach $22.87 billion by 2033, growing at a CAGR of 8.1% due to increasing demand for electric vehicles and consumer electronics, with key battery metals including lithium, nickel, cobalt, manganese, and graphite; the Asia-Pacific region is the largest contributor to the market by revenue. Strategic Partnerships with Tier 1 Global PartnersLarge global partners validate Atlas Lithium's business model, assets, and team.

Strategic Partnerships with Tier 1 Global Partners

A World-Class Technical Team

Leading Investment Bank Named ATLX as 2025 Top PickOn January 28, 2025, H.C. Wainwright & Co., a respected U.S. investment bank, has designated Atlas Lithium (NASDAQ: ATLX) as one of its top picks for 2025, highlighting the company's strategic positioning and growth potential. The investment bank's analysis points to Atlas Lithium's progression toward production, emphasizing the significance of its fully-paid DMS plant and the company's strong partnerships with major lithium companies in Asia. With a "BUY" recommendation, H.C. Wainwright's research underscores Atlas Lithium's potential to become a key player in the global lithium supply chain, particularly noting its advantageous position in Brazil's Lithium Valley and the company's efficient operational model. CRITICAL MINERALS NEWS JUST IN:Atlas Lithium's 30%-owned subsidiary, Atlas Critical Minerals (OTCQB: JUPGF), just delivered game-changing results—including near-surface rare earth mineralization grading as high as 28,870 ppm TREO, 23.2 % titanium dioxide, and graphite concentrates hitting 96.6% purity. Why this matters: - Adds exposure to rare earths, titanium, graphite, uranium, nickel, copper, gold, and more.

- Brazil hosts significant rare earth deposits and is the world's second-largest graphite reserve region.

- Expands Atlas's investment case beyond lithium—with diversification across essential minerals fueling global electrification and security supply chains.

TO SUMMARIZE WHY ATLX SHOULD BE ON YOUR RADAR:With world-class project economics, ultra-low costs, a rapid path to production, and strategic funding already in place, Atlas Lithium is emerging as a standout contender in the race to supply the next wave of global electrification. Backed by experienced leadership, regulatory clarity, and a pipeline of high-potential assets, the company is executing on a clear and compelling roadmap toward scalable, high-margin lithium production. ATLX is ticking every box: - Billion-dollar neighbors

- Government fast-track support

- Strategic partnerships

- Experienced leadership with equity skin in the game

- Major processing plant in-country

- Offtake deals signed

And it's doing all of this at only around $100M market cap—a rounding error for majors circling the space. With robust financial backing secured through $40 million in non-dilutive pre-payment agreements and strong interest in long-term debt financing, Atlas Lithium is exceptionally well-positioned to advance its Neves Project. This strategic capital structure, combined with industry-leading economics and low operational costs, significantly de-risks the project and paves the way for rapid development and growth. As the company continues to execute on its expansion plans across its promising Brazilian lithium assets, ATLX intends to capitalize on the surging global demand for critical battery materials and delivering substantial value in the rapidly evolving clean energy landscape. ATLX's Definitive Feasibility Study also marks a transformational moment not only for the company but for the broader lithium investment landscape. For ATLX, the Neves Project isn't just another lithium project—it's a opportunity for what could become one of the most efficient and profitable hard-rock lithium operations in the world. Disclaimer: We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Trading Wire nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Trading Wire. It is possible that a viewer's entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Trading Wire makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains "forward-looking statements." Such statements may be preceded by the words "intends," "may," "will," "plans," "expects," "anticipates," "projects," "predicts," "estimates," "aims," "believes," "hopes," "potential," or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company's control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company's actual results of operation. A company's actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company's products; the company's ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company's filings with the Securities and Exchange Commission. However, a company's past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources tradingwire.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Trading Wire has no obligation to update any of the information provided. Trading Wire, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Trading Wire encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.Trading Wire, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Trading Wire control, endorse, or guarantee any content found in such sites. Trading Wire does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Trading Wire, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Trading Wire, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Trading Wire uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions. Income Disclaimer

Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions.

Trading Wire has been retained by Atlas Lithuim (NASDAQ:ATLX) to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from Atlas Lithuim (NASDAQ:ATLX) . Questions regarding this website may be sent to editor@tradingwire.com

Trading Wire has received a payment of $1,945,000.00 from Atlas Lithuim (NASDAQ:ATLX)) for the marketing of Atlas Lithuim (NASDAQ:ATLX) . which services include the issuance of this release and other opinions that we release concerning of Atlas Lithuim (NASDAQ:ATLX) Trading Wire has not investigated the background of Atlas Lithuim (NASDAQ:ATLX) . Anyone viewing this newsletter should assume Atlas Lithuim (NASDAQ:ATLX) or affiliates of Atlas Lithuim (NASDAQ:ATLX)) own shares of the Atlas Lithuim (NASDAQ:ATLX) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Trading Wire has received this amount as a production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements regarding Atlas Lithuim (NASDAQ:ATLX)

|

| |