The start of the 2024 NFL season will take place tonight as the reigning Super Bowl LVIII champions, the Kansas City Chiefs, host the Baltimore ...

| Read in Browser |

|

| | Top News  Getty Images The start of the 2024 NFL season will take place tonight as the reigning Super Bowl LVIII champions, the Kansas City Chiefs, host the Baltimore Ravens. It's the second straight year in which opening night will take place at Arrowhead Stadium, and it'll also mark a rematch of the prior season's AFC Championship game. Football is by far the most popular sport in the U.S., which is having big ramifications for the sports betting market and its publicly traded industry players.

What's the spread? Sports betting is now legal in 38 states, including newcomers like Maine, Vermont and North Carolina. Much of the trading is done via smartphone apps, with a sportsbook now available in the pockets of many Americans everywhere. There is also no league as important as the NFL, especially with increasing bets that extend beyond the outcome of games, and into player props, touchdown and yardage bets and even next team odds.

American adults are projected to legally wager $35B throughout this NFL season, according to the American Gaming Association, which would represent soaring growth of 30% Y/Y. Data also shows that public support for the industry continues to grow amid commitments to responsible gaming and consumer protection. Football fans are encouraged to set a budget, keep it social, know the odds, and only play with legal and regulated operators.

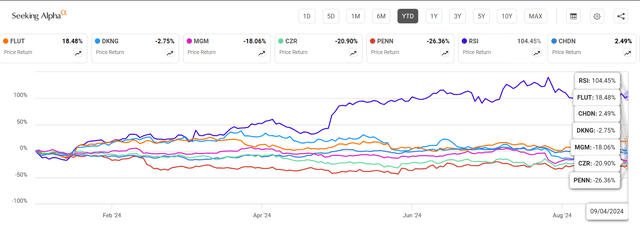

By the numbers: Bank of America estimates that two platforms control the majority of total money bet across the country, with FanDuel (FLUT) at 42% and DraftKings (DKNG) at 34%. The online sports betting handles of smaller players include a 7% share for BetMGM (MGM) (OTCPK:GMVHF), 5% for Caesars Sportsbook (CZR), and 3% for ESPN Bet (PENN). While the latter just launched online sports betting in New York in an expansion push, others are also hoping to boost their national market share, like Fanatics and Rush Street Interactive (RSI). See more analyst commentary here. | | | | | Bonds U.S. Treasury yields fell across the board on Wednesday. Growth concerns and a softer-than-expected July job openings print lifted bets of a 50-basis point interest rate cut by the Federal Reserve this month. The yield curve between US10Y and US2Y briefly normalized for the second time in over two years, after un-inverting last month following 25 consecutive months of inversion. An inverted yield curve is widely seen as a recession indicator, but normalization of the curve is not necessarily a positive sign as the curve can un-invert before a recession hits. ( 3 comments) | | M&A There's more drama enveloping the American steel industry. The Biden administration has reportedly concluded that the nearly $15B sale of U.S. Steel ( X) to Nippon Steel ( OTCPK:NPSCY) would pose a national security risk that can't be mitigated by either company. U.S. Steel insisted that there were no such issues, outlining that it would "pursue all possible options under the law to ensure this transaction closes," but its stock still plummeted nearly 18% on the news. CEO David Burritt also announced the firm would close steel mills and move its HQ out of Pittsburgh if the deal collapses. ( 186 comments) | | Regulation Singapore has announced that the close contacts of suspected mpox cases would be quarantined for a period of three-weeks, as the city-state takes up preventive measures to minimize the spread of the virus. Apart from this, Singaporean authorities have also put in place temperature and visual screening at airports and sea checkpoints. World Health Organization declared mpox as a global health emergency in mid-August following the appearance of the more lethal clade I strain of mpox virus. | | Today's Markets In Asia, Japan -1.1%. Hong Kong -0.1%. China +0.1%. India -0.2%.

In Europe, at midday, London -0.1%. Paris -0.7%. Frankfurt +0.2%.

Futures at 7:00, Dow flat at +0.04%. S&P flat at +0.02%. Nasdaq -0.1%. Crude +0.6% at $69.59. Gold +0.8% to $2,545.10. Bitcoin +0.6% to $56,824.

Ten-year Treasury Yield +1 bps to 3.77%. Today's Economic Calendar | | | | | Seeking Alpha's Wall Street Breakfast Podcast Seeking Alpha's Wall Street Breakfast podcast brings you all the news you need to know for your market day. Released by 8:00 AM ET each morning, it is a quick listen that you can put on as you get ready to start your working day. | | | | |

114301269752 https://email-hs.seekingalpha.com/hs/preferences-center/en/page?data=W2nVjwf3Y2wXtW1_psLl45pNXhW3K9cHX1ND4J1W3NzjHB2zvqz-W45GB532qCZF9W47V20V32mv57W3XFYnS2vC9SgW2nBCrH4kFfY6W2TM91X1NjNZHW2PxRhh3VWsnHW400qLk2YrX_8W2-qRPn1V3NvTW3T2vll4hstPkW43nhVC1Vy571W4tGwMf3VBQGXW2RCrPd3G_V2LW21chGQ2sSM5NW3SN4mB4th83cW36hrG63d8vBpW47C2Nm1_9kDlW2CMHBV2THRQ2W4tmnvH21rGw3W1Q5mM03LDR6PW1BvcFd3NCpctW3GYrRq25fKmJW49wc2s1NgJ7FW20Z6Mn1V0MzyW2r2fV72-ByyBW43nNqs3yWB32W43yTrN2Rk1kJW2nN5cQ49v12KW3dxy233NDd4BW41J9T22RJsDmW3B_nMf2xQJb_W2r4qy93dqhG5W1Vd4L74rxHdLW2xNw1Y4fz5-MW2nXW093jgnxdW3dxvjT3GLf0GW30sLws327xc6W1St_DV2521BQW3z1cPl3-0D5lW2FRfQb4crd6TW2YykQn4pkL3lW3K9DL43VHl-bW3bqXp72w3YKDf2WhP8g04