Cheers can be heard from the investing world as the much-anticipated Fed easing cycle finally begins. It's been four years since the FOMC last cut rates, and 14 months of holding them steady, so today's rate decision, press conference and policy projections will all be a big deal. There's been much debate over how fast the Fed will move as the starting gun is fired, so stay tuned for the headlines on Seeking Alpha starting at 2 PM ET.

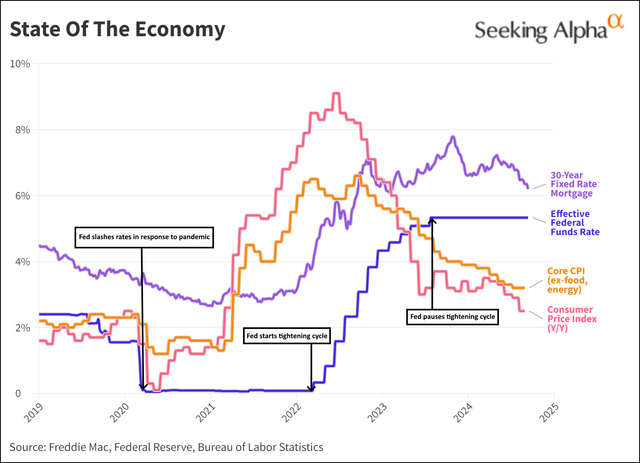

Soft landing? While inflation data has drifted downward toward the Fed's 2% goal, unemployment has risen faster than expected since the last FOMC decision in July. That has led to worries by the central bank about cooling labor market conditions, which is harder to stop once demand for workers has softened. It's even prompted to talk about a stronger level of rate cuts, but the majority of Wall Street Breakfast subscribers (79.4%) still expect the Fed to trim its benchmark lending rate

by 25 basis points, compared to some (20.6%) who see a 50-bps reduction.

While the pace of the initial cut will be revealed in the coming hours, a

bigger area of focus will be the federal funds rate range for the end of 2024, next year, and in the longer term. Look to the FOMC's dot plot for that insight. In the last Summary of Economic Projections, issued on June 12, the median fed funds rate projection was 5.1% at the end of 2024 and 4.1% for 2025, and how much that changes from the prior outlooks will be exceptionally important for investors.

SA commentary: "While the near-term volatility could persist, a more accessible monetary stance should lead to improved growth and increased liquidity, a highly constructive dynamic for high-quality stocks and other risk assets," Investing Group Leader Victor Dergunov wrote in

Finally, It's Time To Cut Rates. "Corporate earnings remain healthy, and despite the potential temporary growth slowdown in AI and other segments, we could see improving and better-than-expected earnings in future quarters."