+ Antti Ilmanen, Richard Ennis, Verdad, Michael Cembalest, Bethany McLean & More

| "There's very little I like shorting more than hubris." | | | | — Cade Massey |

|

| Research | | This paper is Part I in a series from Antti Ilmanen, which tries to understand how investors actually form long-run return expectations. He contrasts "objective" yield-based expected returns and "subjective" rearview-mirror expectations and argues that "rearview-mirror expectations have made many investors too optimistic on risky and private assets after the good times following the Global Financial Crisis, and too cautious on liquid diversifiers." | | | | Part II in the series linked above applies the ideas to expectations for U.S. equities versus the rest of the world by analyzing the drivers of relative performance—in particular the different roles of fundamentals and valuations—and assessing the most likely implications for future returns. |  | As of 5/9/2025 |

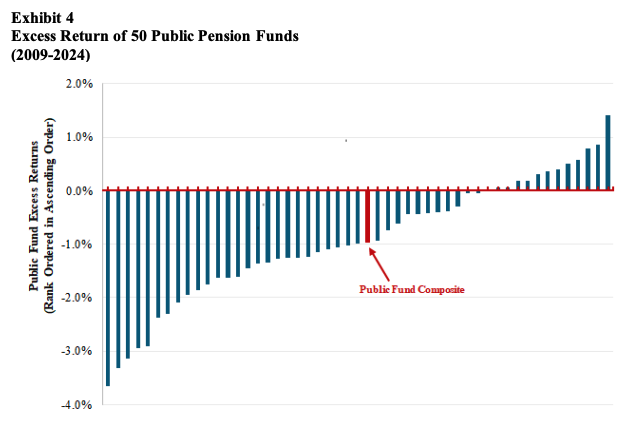

| | | Ennis argues that alternative investments bring extraordinary costs but ordinary returns. He estimates a diverse portfolio of alternatives cost costs at least 3% to 4% of asset value, annually. |  | Source: Richard M. Ennis, The Demise of Alternative Investments, as of 3/4/2025 |

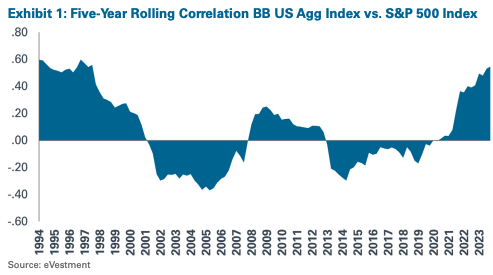

| | | NEPC looks at true diversifying strategies - those that utilize investment processes that produce returns driven by idiosyncratic risk rather than factor risk. They walk through a number of diversifiers, including trend following, global macro, and event-driven. |  | As of 4/10/2025 |

| | | Bonus Content | Charles Mann has written three parts in an ongoing essay series on the hidden mechanisms that support modern life: | We live like royalty and don't know it. Link Breakfast for eight billion. Link A spring in every kitchen. Link

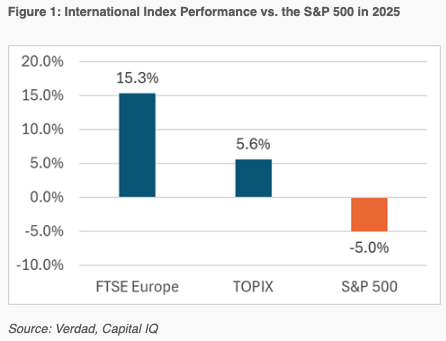

| "Diversifying equity allocations outside of the United States seems like a prudent move in this macroeconomic environment, and, given valuations, international outperformance is a trend that could continue for years to come." Link |  | As of May 5, 2025. |

| | Podcasts | | | | |  | 5/8/2025 - 78 minutes |

|

| | Starting at 28:30, Cembalest covers the macro landscape, offers practical advice for navigating today's volatility, and shares why he's still optimistic that markets could normalize. | Apple | Spotify | YouTube |

|

|

| |

| | |

| | | | |  | 5/5/2025 - 55 minutes |

|

| | Business Insider founder Henry Blodget covers the state of the AI boom, what lessons we can draw from the dot-com era, and what's changed on Wall Street over the last 25 years. | Apple | Spotify | YouTube |

|

|

| |

| | |

| | | | |  | 5/7/2025 - 35 minutes |

|

| | McLean discusses various topics including the current state of private equity, U.S. healthcare, Fannie Mae and Freddie Mac, tariffs, and Warren Buffett's enduring legacy. | Apple | Spotify | YouTube |

|

|

| |

| | |

| What Else Is Happening | | |

|

| | | | Copyright © 2025 The Idea Farm, L.P. All Rights Reserved. | The information contained in this communication is of a general nature for informational purposes only, and does not constitute financial, investment, tax or legal advice. The information contained within this communication reflects the opinions of those referenced herein, and do not reflect the opinions of The Idea Farm, L.P. and its affiliates. Such opinions expressed herein are as of the date of production and are subject to change at any time without notice due to various factors, including changing market conditions or tax laws. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. Any links to third party websites are offered only for use at your own discretion. The Idea Farm L.P., and its affiliates, are separate and unaffiliated from any third parties listed herein and is not responsible for their products, services, policies or the content of their website. All investments are subject to varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy or product referenced directly or indirectly in this communication will be profitable, perform equally to any corresponding indicated historical performance level(s), or be suitable for your portfolio. Past performance is not an indicator of future results. | Update your email preferences or unsubscribe here © 2025 The Idea Farm 3300 Highland Avenue

Manhattan Beach, California 90266, United States of America | | Terms of Service |

|

|

|

|

|